$53,000,000 – Refinance

$53,000,000 – Refinance

10 Year Fixed Rate Term

10 Years of Interest Only

Non-Recourse

6.81% fixed rate

DETAILS:

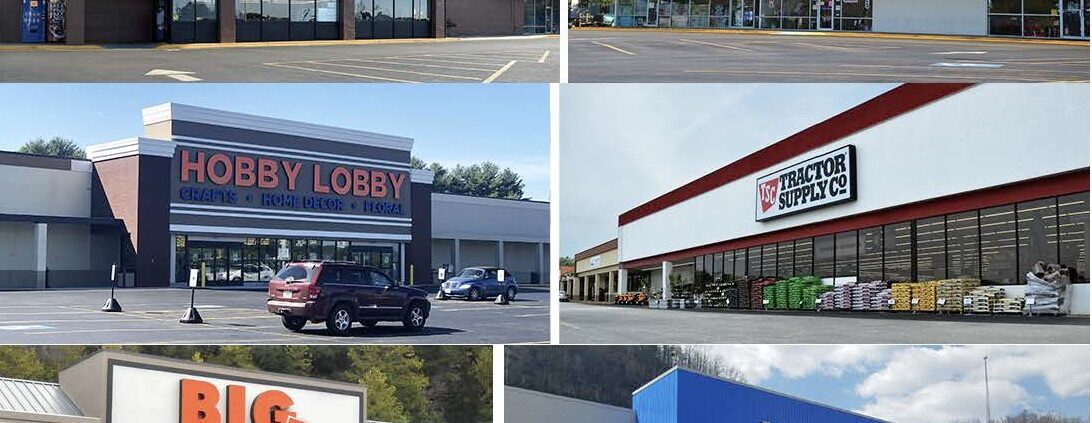

These 11 properties include a total of 181 tenants, which includes: Walmart, Krogers, Marshalls, Hobby Lobby, Big Lots, Harbor Freight, Hibbet Sports, Bealls, Ollie’s Bargain Outlet, Burke’s Outlet Store, JC Penny, Piggly Wiggly, Dollar Tree, Farmers Home Furniture, Shoe Show, Sav-A-Lot, Dunhams, True Value Hardware. A total of 1,354,381 SF (rentable).

Sponsor sought a full term interest only loan with flexible terms in order to allow them to continue with their business plan for each property.

Challenges overcome include: anchor lease roll in short term and mid term, tertiary locations of some of the properties, as well as escalating operating costs (insurance for example) and other expenses.

This is the third portfolio loan that Banyan Commercial Capital has closed for this client with a total relationship of over $132,000,000 so far.

The loan is underwritten off of the interest only payments thus giving the sponsor plenty of room against potential performance issues (leasing, retention, inflation, etc.).

In addition, this loan allowed for enough cash out to allow the sponsor to pay off all debt on several other properties that are now owned free and clear.

Zach Nimhauser – zn@banyancc.com

Michael Brown – mb@banyancc.com

$21,000,000 – Ground-Up Construction Loan

$21,000,000 – Ground-Up Construction Loan

$33,750,000 – Ground-Up Construction Loan

$33,750,000 – Ground-Up Construction Loan

$13,600,000 – Acquisition Perm

$13,600,000 – Acquisition Perm

$7,000,000

$7,000,000

$1,462,500

$1,462,500

$3,350,000

$3,350,000